Weekly Recap:

Last week Fitch Ratings became the second credit rating agency to downgrade the sovereign rating of the United States one notch from AAA to AA+ (the first was S&P in 2011). While arguably of no real concern in terms of a direct impact on US borrowing costs, this move did dampen sentiment and may have contributed to lower stock and bond prices.

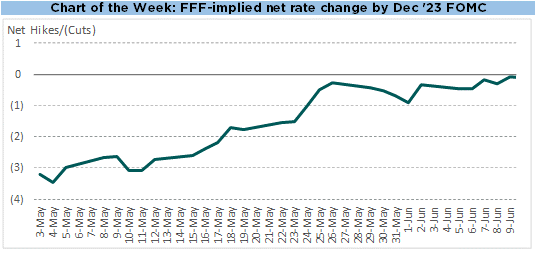

Meanwhile, the Treasury yield curve steepened last week due to a combination of supply technicals and macroeconomic data. At the front end of the curve, rates were lower on the week after dropping significantly on Friday thanks to a soft(ish) nonfarm payroll report. Futures markets discounted the probability of another rate hike this year, while 1y Treasury yields fell 8bp and 2y yields dropped 9bp.

Conversely, rates rose in the belly and long end of the curve thanks to the announcement of greater-than-expected supply of new borrowing from the US Treasury, which in turn contributed to P/E multiple compression, sending stock prices lower.

The most significant macro data last week was the monthly nonfarm payroll report from the Bureau of Labor Statistics. While unemployment remains near historic lows, the report was slightly softer than expected on balance:

* Change in nonfarm payrolls = +187k vs. consensus of +200k (net 2m revision -49k)

* U-3 Unemployment = 3.5% vs. previous month 3.6%

* U-6 Underemployment = 6.7% vs. previous month 6.9%

* Average hourly earnings = +0.4% m/m (prior month was also +0.4%)

* Average weekly hours = 34.3 (down 0.1 from prior month of 34.4)

Albion’s “Four Pillars”:

Economy & Earnings

The US economy showed resilience in the first half of 2023, and Wall Street analysts expect full-year corporate earnings to be roughly flat y/y. Albion’s base case expectation is that the US economy will enter recession in the second half of 2023, putting downside pressure on earnings.

Valuation

The S&P 500’s forward P/E of 19x is above the long run average, so valuation could be a headwind to future returns. More predictive metrics like CAPE, Tobin’s Q, and the Buffett Indicator (Mkt Cap / GDP) suggest that compound annual returns over the next decade are likely to be in the mid single digits.

Interest Rates

Rates rose dramatically in 2022 due to a sharp pivot in monetary policy, and have remained elevated in 2023 as progress on inflation has been slower than hoped. Futures markets now imply that the Fed Funds overnight interest rate will remain unchanged at 5.25-5.50% until at least March of next year.

Inflation

After reaching 40yr highs in spring of 2022, inflation has moderated somewhat over the past 12 months. Goods inflation has fallen due to softening demand and excess inventory, while services inflation remains elevated, in part due to shelter costs which are somewhat lagged.